Part-D of Medicare is a government-run insurance plan for the purchase of pharmaceuticals. Hospitalization costs are partially covered by Medicare Section B. This post will go through each of these plans i.e., Medicare Part D & Part B in detail and provide advice on how to get the most out of them for your loved ones.

Medicare Part-B & Part-D: An Overview

The United States federal government provides a prescription medicine program called Part D of Medicare. The Medicare Prescribed Medication Program (Part-B) was replaced by it in 2003.

People who are over the age of 65, or who have a handicap, are eligible for Medicare Part D. If your yearly income is less than 133 percent of the national poverty threshold, you may qualify for Medicare Part D. Quarterly premiums, copayments, and deductible are only some of the coverage choices provided by the program. You’ll need to cover the cost of your prescription drugs out of pocket, too, with a few notable exceptions.

The Medicare Part D premiums for certain Medicare recipients may be discounted or waived entirely. Call Medicare at 1-800-MEDICARE (1-800-633-4227) to see whether you are eligible. Part D is available to anybody with an active prescription drug treatment plan, regardless of Medicare eligibility. Inquire about any premium and/or copayment subsidies available via your plan.

Related article: Medicare Part-A and Part-B Qualifying Benefits

Private insurance policies that offer prescription medication coverage may be purchased if you lack access to such coverage via your employer or another public program.

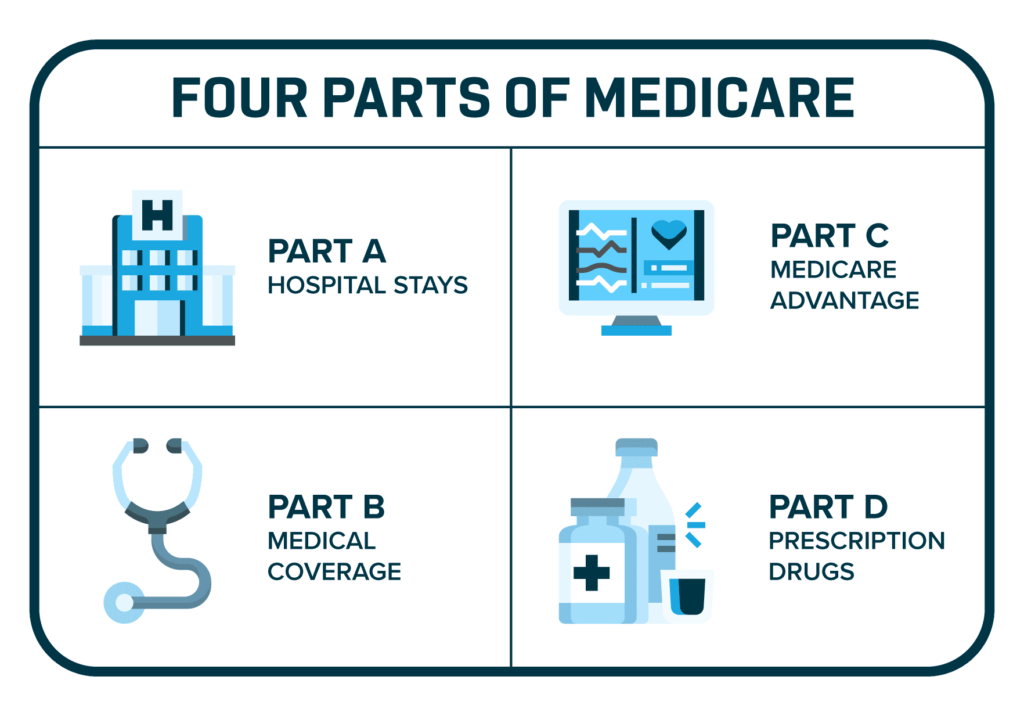

Part B of Medicare is devoted to covering the cost of medically necessary medications. Medicare Part D is short for Medicare Part D Prescribed Drug Program. It’s possible to qualify both for Medicare Part-B and Part-D if you’re currently registered in Medicare.

Please read on for a detailed explanation of Medicare Parts B and D.

Part-B of Medicare

Medicare Part-B is available to anyone who are 65 or older or who are disabled. Prescription medicine costs may be mitigated by this scheme. Both a Basic and a Standard plan are available to you. The Standard plan offers more perks than the basic one but may come at a higher price.

Part-D of Medicare

It’s possible to qualify both for Medicare-Part B & Medicare-Part D if you’re already enrolled in Medicare. Prescribed medicine costs may be mitigated by this scheme. There are two options available to you: the standard plan and the Extra Help-plan. The Extra help program offers more perks than the Standard plan, but it might be more expensive.

The maximum yearly benefit for Part D of Medicare is $6,700 for a single person and $13,000 for a family. Monthly out-of-pocket maximums of $2,500 are included in the coverage cap.

In what ways is Medicare Part-B of the program limited in its coverage?

There are no yearly or family size restrictions on Medicare Part-B insurance. But there is an annual cap of $5,000 on how much will be paid for. There is a $2,500 monthly limit on out-of-pocket costs.

Contact our toll-free line or check out our official website if you have concerns regarding your Part B of Medicare insurance.

Medicare Part-D: the Coverage Limitations

In Medicare’s Part-D, coverage is unlimited. If you do not qualify for Medicare, you are free to get enrolled in a plan that accepts non-Medicare patients.

What is the cost for Medicare’s Part-D?

Prescription medication coverage is provided under Part D of Medicare. Part-B covers both inpatient and outpatient treatment, whereas Part D covers prescription medications for outpatients.

Part D of Medicare may be purchased in a few different ways. Costs and coverage maximums vary amongst the plans. the Medicare website has details about its many programs.

Whereas, Part-D of Medicare is a program that may assist Medicare recipients cover the cost of their prescribed medications. Most generic drugs and a wide selection of speciality pharmaceuticals are covered under the program, among other advantages.

Payments are not a flat rate and will change based on the amount you make and the specific plan you select. A monthly premium of $35 is estimated for a typical plan. Costlier plans may provide better protection or additional perks like reduced or free medication costs.

What is the fee for the Medicare Part-B?

Part B of Medicare is a supplementary health insurance policy designed to pay for additional medical expenses. However, someone’s Social Security payout will be reduced by the amount of their Part-B premiums. Hence, Medical treatment, including hospital stays, doctor’s visits, and medicines, are all covered under Medicare Section B.

Medicare Part B comes in three different variations:

1. Basic

2. Standard

3. Enhanced

The most inexpensive insurance is called “basic coverage,” because it only pays for emergency care and routine doctor’s appointments. All the advantages of basic protection, including prescription medicines and other offerings, are included under standard insurance. The costliest option for Medicare-Part B protection, greater protection pays for a wider range of medical expenses than basic coverage.

Can you still qualify for Medigap insurance if you’re receiving SSDI?

If you are already receiving Social Security Disability Insurance (SSDI), then you may keep your Medigap insurance. In most cases, you’ll have the same level of protection as if you weren’t receiving SSDI. There might, however, be an exception. Moreover, the cost of your premiums might go up, and you could lose access to certain services.

Conclusion

The following piece goes over how Medicare operates. Moreover, if you are qualified for advantages, as well as cover the fundamentals regarding the requirements. Medicare offers this avenue for those who qualify due to age, illness, or other special circumstances. To guarantee a happy and safe future, those who are close to being eligible for Medicare should research their alternatives, join when required, and make educated decisions regarding their healthcare insurance.